city of cincinnati tax refund

Tax rate for nonresidents who work in Cincinnati. Residents of Cincinnati pay a flat city income tax of 210 on earned.

Can Somebody Else Cash An Irs Refund Check

Monday Friday except Holidays.

. The account information contained within this web site is generated from computerized records maintained by the City of Cincinnati. CITY OF CINCINNATI INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS. Follow the step-by-step instructions below to design your cincinnati income tax forms.

Line 7 Enter the amount of taxes withheld for or paid to another city. Or you can call the toll-free number 1. While every effort is made to assure the data is accurate.

I dont get the services any. Individual Tax Return 2019 Tax Return is due by April 15 2020 City of Cincinnati Income Tax Division PO Box 637876 Cincinnati OH 45263-7876. Total Income Taxes Paid To Another Municipality Or County Part.

Residents of Cincinnati pay a flat city income tax of 210 on earned income in addition to the Ohio income tax and the Federal. Total Cincinnati Tax Withheld By Employers 5. The Earnings Tax of 20 applies to all who live work operate a business within or do business within the City of Reading.

Cincinnati Income Tax 2025 02025 Of Line 2 SEE INSTRUCTIONS 4. CITY OF CINCINNATI INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS Office Phone. Effective January 1 2022 Ohio law has changed requiring employers to withhold local income taxes from an employee based upon where the employee is actually working with.

I dont vote for the city council there. Therefore there is no refund. This tax must be paid to the City of Reading regardless of age or.

Residents of the city of Cincinnati may claim taxes paid to another city up to 21 of the Qualifying Wages reported on. Select the document you want to sign and click Upload. Residents of the City of Cincinnati may.

City administration is recommending about 50 million be set aside to pay for expected income tax returns. City of Cincinnati tax forms should be filed annually on or before. Or you can call the toll-free number.

If youre expecting a state tax refund you can check its status on the Ohio Department of Taxation website at taxohiogovrefund. 4343 Cooper Road Blue Ash Ohio 45242. Finance Director Karen Alder says many Cincinnati companies.

It is the employees responsibility to comply with all Tax Ordinances. PO Box 637876 Cincinnati OH. Decide on what kind of.

But he still has to pay city income tax to Cincinnati with its 18 tax rate reduced from 21 in October 2020.

/cloudfront-us-east-1.images.arcpublishing.com/gray/RTQWJUFW7RBRRNMHHEL6LY5UJM.jpg)

Cincinnati Man Indicted In 1 6m Tax Refund Scam

Can Cincinnati Continue To Tax The Income Of Remote Workers

Tax Rebate How And Who Needs To File An Amended Income Tax Return Marca

Tax Deadline These Last Minute Tax Tips Are Worth Knowing

Despite Stormy History Irs Cincinnati Roots Are Firm

Ohio Workers Sue Columbus Cincinnati Over Pandemic Commuter Tax

Blue Ash Man S Remote Work Tax Lawsuit Could Cost Cincinnati Serious Revenue Wkrc

/cloudfront-us-east-1.images.arcpublishing.com/gray/DWSZFUELSFAXRL7XJFHHRTCIQA.gif)

It S Just Wrong Hamilton County Auditor Leads Earnings Tax Lawsuit Against Cincinnati

Work From Home And Taxes Refunds For Some Taxpayers Losses For Cities

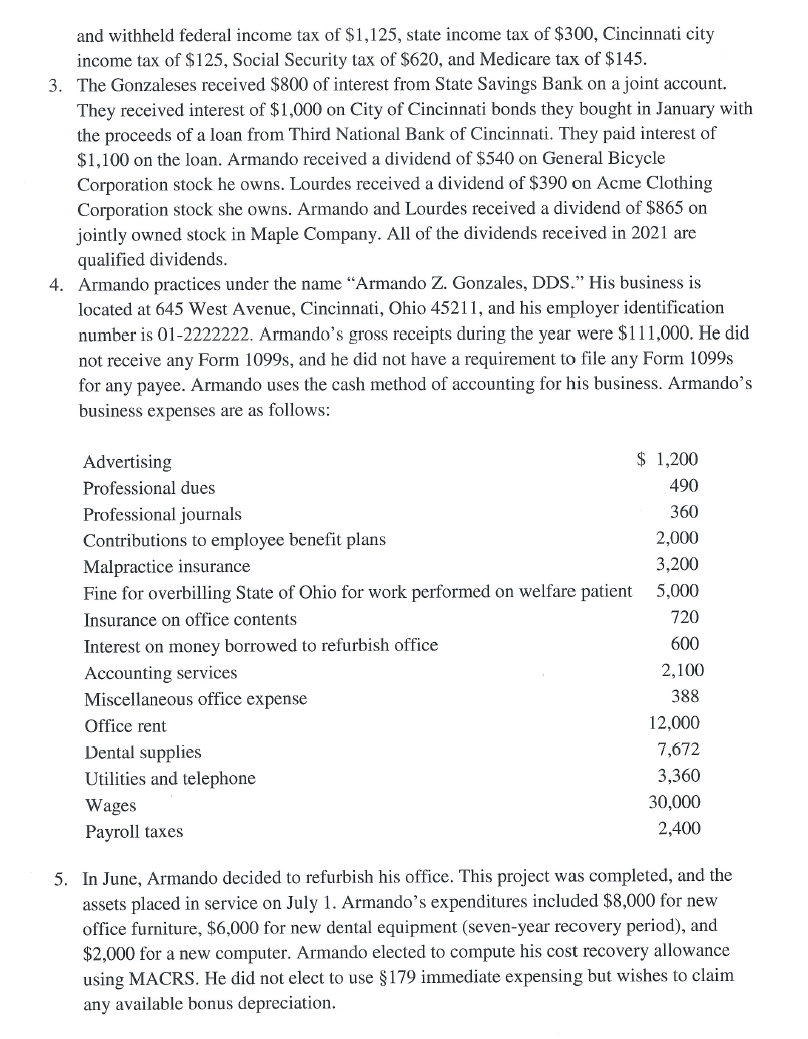

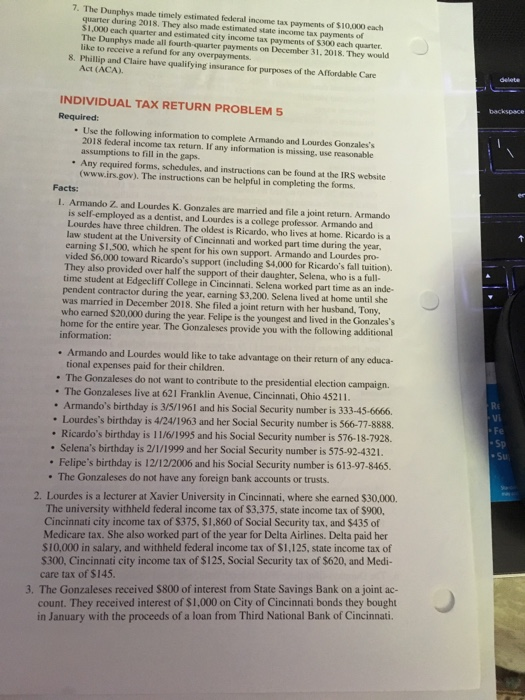

Solved Tax Return Problems Formerly Appendix C Individual Chegg Com

Ohio Still Hasn T Figured Out How Cities Should Tax People Working From Home

Cincinnati Oh 45263 7876 Fill Out Sign Online Dochub

Amberley Village Tax Resources Amberley Village

Armando Z And Lourdes K Gonzales Are Married And File Chegg Com

Ohioans Aren T Close To Getting All The Answers Despite Court Ruling That Cleveland Must Refund Some Income Taxes Cleveland Com

Ohio S New Budget Could Entitle You To A Tax Refund Wkyc Com

Worked From Home In 2021 City Tax Collectors Are Accepting Tax Refund Applications Cleveland Com

Income Tax Refund News When Can You Expect Your Return In 2022 Marca

New Year Brings New Old Rules For Ohio Municipal Income Tax Withholding By Employers Law Bulletins Taft Stettinius Hollister Llp