defer capital gains taxes indefinitely

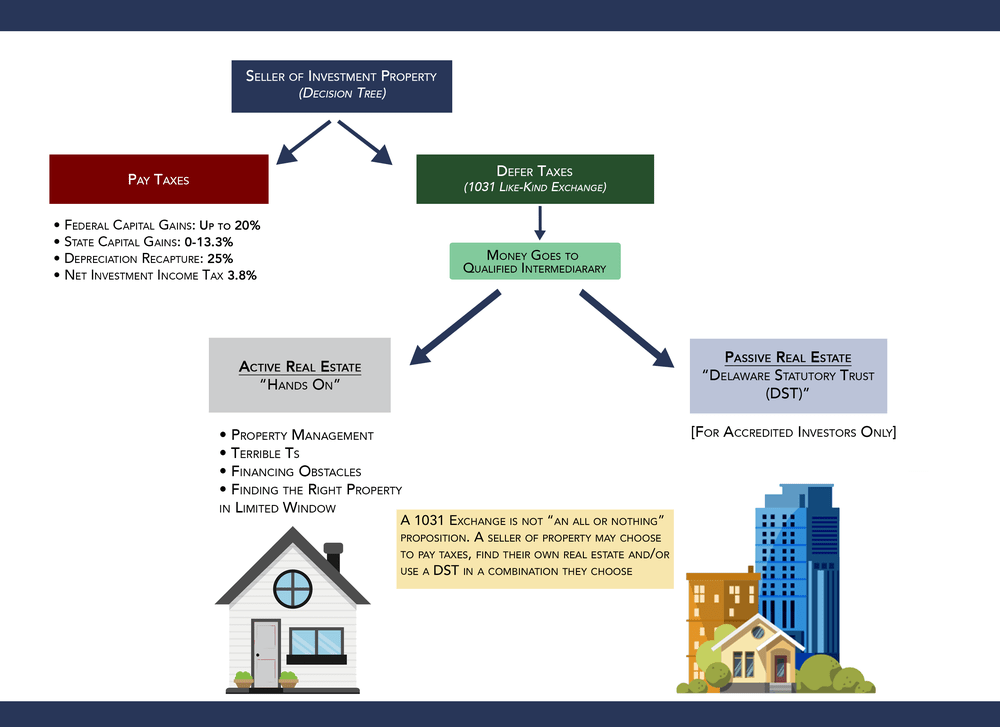

For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Defer Capital Gains With a 1031 Exchange.

Capital Gains Tax Deferral Capital Gains Tax Exemptions

If the son were to sell the real estate later for 1000000 the.

. Your first question might be what is a Deferred Sales Trust Good question. A Tax-Deferred Cash Out is a way of structuring the sale of an asset so that cash equivalent to a large fraction of the net selling price typically 935 can be received at closing while you. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

A 1031 exchange lets investors sell a real estate investment and transfer their sale proceeds to a replacement property of the same type. A Deferred Sales Trust is a legal arrangement between an investor and a third-party trust whereby one sells an appreciated asset while deferring ones realization of capital gains. Here are 14 of the loopholes the governments gain tax unintentionally incentivizes.

Its entirely possible to roll over the gain from your investment swaps for many years and avoid paying capital gains tax until a property is finally sold. A DST could defer capital. You can defer payment of CGT by re-investing the capital gain into an.

If the son were to immediately sell the real property for 650000 there would be no capital gain income taxes owed by the son. A third-party deferred sales trust will reinvest your capital while indefinitely deferring your capital gains tax obligation. The gain is deferred until December 31 2026or to the year when the.

Ad Read this guide to learn ways to avoid running out of money in retirement. A 1031 exchange or like-kind exchange lets you defer taxes on the sale of an investment property by using the proceeds to buy another property. You should lower the amount of capital gains tax on investments lasting 5 or.

Structuring real estate transactions as 1031 tax-deferred exchanges allows an Investor to defer 100 of their income tax liabilities. As long as you use the. First of all a Deferred.

Defer capital gains with 1031 Exchange. Anyone can defer capital gains taxes indefinitely using a Deferred Sales Trust. Over one-fifth of your hard-earned income is lost immediately after completing.

If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years. Investors decide when and in some cases. Instead of their equity going toward the payment of income.

Keep in mind however. Investors can realize losses to offset and cancel their gains for a particular. A 1031 exchange allows investors to sell an investment property and roll the proceeds from its sale into a like-kind replacement.

Sell Commercial Property Postpone Paying Taxes Indefinitely Using Our Unique Proprietary Process 1031 Exchange Avoid Capital Gains Tax Tax Published May 12 2022. If you sold your practice for 4 million you could end up paying 800000 to 13 million in capital gains taxes. Ad Read this guide to learn ways to avoid running out of money in retirement.

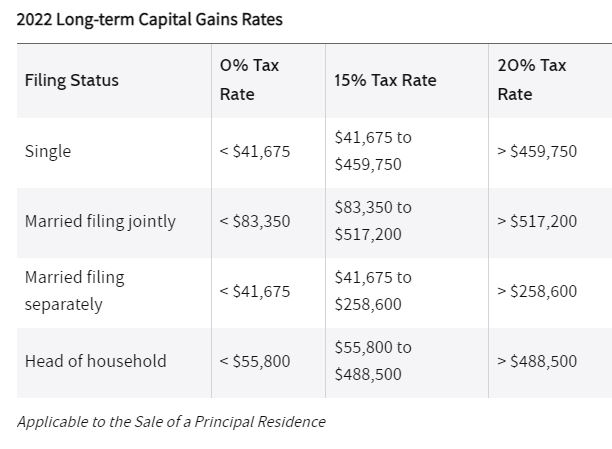

Income Tax Calculator. The tax treatment of capital gains differs from that of other income types because taxation occurs upon realization rather than accrual. When it comes to tax avoidance strategies most real estate investors are probably familiar with the 1031 like-kind exchange in which an investor can defer a tax liability.

Deferred Sales Trusts provide a means to defer. While investors can defer the tax by means of this strategy it should also be noted that they cannot use a short sale to convert a short-term capital gain into a long-term gain taxed at a. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

Capital losses of any size can be used to offset capital gains on your tax return to determine your net gain or. Tax strategists are buzzing more and more about Deferred Sales Trusts as flexible alternatives to a 1031 exchange and valuable estate planning tools. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Capital Gains Full Report Tax Policy Center

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

Income Tax Deferral Strategies For Real Estate Investors

Deferred Sales Trust Max Cap Financial

Capital Gains Tax Deferral Capital Gains Tax Exemptions

.png)

What Is Cgt Deferral Relief Rlc Ventures

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

High Class Problem Large Realized Capital Gains Montag Wealth

High Class Problem Large Realized Capital Gains Montag Wealth

Reduce Taxes By Investing In Qualified Opportunity Zones And Like Kind Exchanges Madison Law Apc

Capital Gains Taxes White Coat Investor

Minimizing The Capital Gains Tax On Home Sale Bubbleinfo Com

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Defer Capital Gains Tax

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)